Ferrari Daytona Market

Mecum Auctions have 70 different Ferraris consigned and set to be offered for sale at their 2026 Kissimmee auction that will take place January 6-18, 2026. The most significant of these is undoubtably the 1962 Ferrari 250 GTO that was displayed at their Monterey auction this year, but it’s worth noting the five different Ferrari Daytonas that will be on offer. Four of these are the Berlinetta model with one Spider joining them, but we’re going to take a look at how the market for the Daytona has performed in recent years and what to expect moving forward.

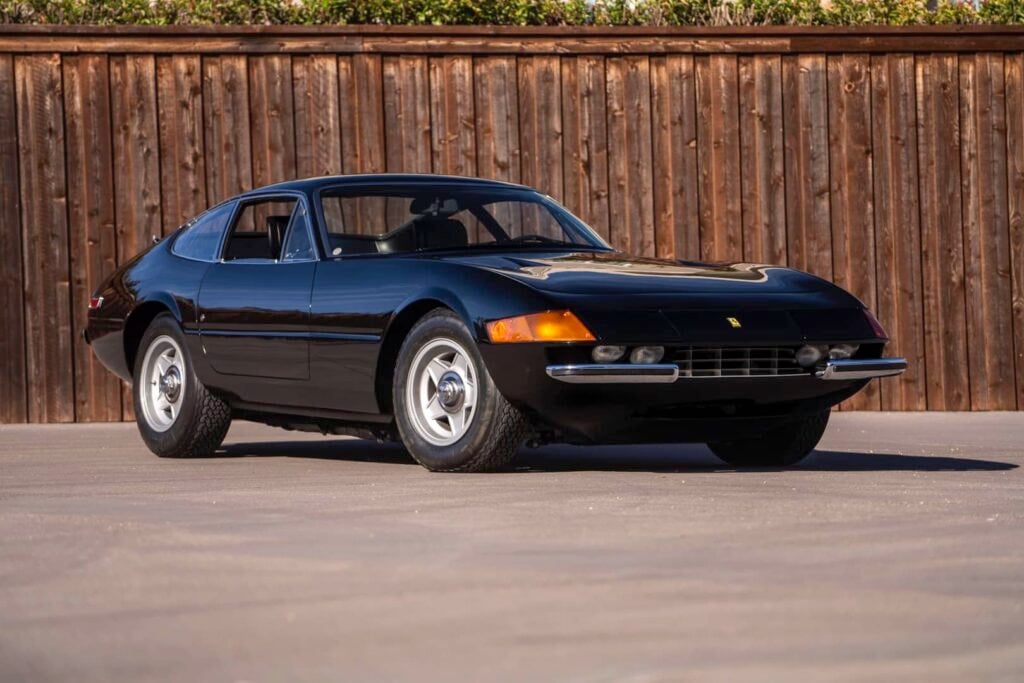

Ferrari Daytona Significance

The Ferrari 365 GTB/4 Daytona is renowned as one of the most iconic car designs ever made. It first appeared at the 1968 Paris Auto Salon, showcasing Ferrari’s advanced road-car engineering with its front-engined V12 grand tourer configuration. This powerful vehicle earned speeds up to 174 mph and was famously nicknamed “Daytona” following Ferrari’s impressive victory in the 1967 Daytona 24 Hours race. However, despite its historical importance and unmistakable presence, the Daytona’s market performance over recent years reflects a trend towards declining interest, more discerning buyers, and a shifting landscape in the collector car world.

Half-Decade of Moderate Decline

From 2020 to 2025, the Ferrari 365 GTB/4 Daytona saw a noticeable drop in its value. The Hagerty Price Guide indicates that an example in excellent condition, worth $720,000 in 2020, is now valued at about $655,000 – a decrease of nearly nine percent in nominal terms. Considering inflation adjustments, the actual decline is closer to fifteen percent, which signifies a significant reduction in value for collectors who purchased these cars when prices were highest.

The path wasn’t straightforward. During the pandemic years of 2020 and 2021, when auction activities decreased significantly, asking prices stayed consistent despite slower activity. The adjustment started in 2022 and picked up pace by 2023, with Hagerty lowering its valuation to $680,000. By 2024, prime examples were valued at $655,000, a level they have maintained since then.

Auction results reveal a more nuanced scenario. Over this five-year span, the average sale price for standard Berlinetta coupes was around $605,000, though individual outcomes varied greatly depending on factors like provenance, condition, and documentation. A 1972 model requiring restoration fetched only $401,000 at RM Sotheby’s Monterey in August 2023, marking the lowest recent sale for that model. On the other hand, models certified by Ferrari Classiche with low mileage and remarkable histories have sold for upwards of $850,000, highlighting the increasing difference between regular and exceptional vehicles.

Broader Trends in the Market

The overall collector car market has undergone a “stabilization,” with experts noting that it has leveled out after giving up some of the gains it made during the pandemic.

A number of factors have led to this adjustment. Higher interest rates have reduced the tendency for people to buy on speculation, which had driven up prices in the past. Economic uncertainty has also led collectors to be more discerning, focusing on the most outstanding vehicles while ignoring those of lesser quality. Maybe the most important factor, though, is the changing makeup of the collector car community, which is undergoing a shift from one generation to the next – a development that has been anticipated for some time.

The group of people who typically collect vintage Ferraris with engines in the front – mostly wealthy individuals from the baby boomer generation who have long admired these cars – is getting older and no longer as involved in collecting. According to Hagerty’s analysis, classic Ferraris from a certain era remain “extremely desirable among older collectors” but “don’t have as much recognition with younger generations who expect a seven-figure entry price to buy world-beating performance.” Younger collectors, including millennials and Gen Z, are now making up a larger part of the market and tend to be more interested in iconic Japanese cars, old Porsches with air-cooled engines, and modern supercars that can offer an analog driving experience but with modern reliability.

The rate at which Daytonas sell at auction – currently around 62 percent – shows this trend. About four out of ten cars put up for auction don’t find buyers, indicating that the prices being asked are too high compared to what people are willing to pay. Sellers who expect to get very peak-era results are often disappointed, while those who set more realistic auction reserves tend to have successful sales.

What Sets Strong Performers Apart

In this difficult market, some Daytonas are still performing well. The key factors that set them apart are always the same: detailed records, certification from Ferrari Classiche, matching numbers for all parts of the engine and transmission, and either being extremely well-preserved or restored to a high standard. For the most valuable ones, having a history in competitions or being owned by someone famous also plays a role.

There’s now a big difference in value between cars made for racing and those for everyday driving. For example, a 1973 Daytona Competizione Series III sold for $8,145,000 at Gooding Christie’s in August 2025, setting a new record for the 365 GTB/4 model. This price is about twelve times higher than what you’d pay for a similar car that wasn’t made for racing, showing how a car’s racing past can change its appeal and put it in a different class.

The 365 GTS/4 Spiders, of which only 122 were made, are in a league of their own. If they’re in great condition, they can sell for around $2.2 to $2.5 million – roughly three and a half times more than their coupe versions. Since there aren’t many of these convertible models around, and they’re especially popular among collectors in California, they’re somewhat shielded from the economic downturn affecting the coupe market.

What to Expect for the Daytona in 2026

As we approach 2026, experts expect the market to remain relatively stable, without any drastic changes in value. The Daytona’s worth is unlikely to increase significantly unless there are major economic shifts or a change in collector interests. However, it’s also unlikely that its value will drop dramatically – the market seems to have adjusted to its new normal after the post-pandemic correction.

There are several reasons to be cautiously optimistic. The collector car market showed its strength at Monterey Car Week 2025, with total sales of over $430 million and a healthy sell-through rate of 78 percent. Classic Ferraris are still attracting bidders, even if their prices aren’t as high as they used to be. The release of Ferrari’s first fully electric vehicle in late 2026 might actually increase interest in classic V12 models among collectors who want the “last real Ferraris.”

The broader collector market is also getting a boost from newer cars becoming eligible for import, which is bringing in new enthusiasts and changing the focus away from older classics. For the Daytona, its historical significance as the last front-engined two-seat V12 berlinetta – a title it held for nearly three decades until the 550 Maranello arrived in 1996 – gives it a lasting importance that goes beyond short-term market ups and downs.

For people looking to buy, 2026 could be a good time to make a purchase. Prices have dropped from their peaks in 2015-2018, when top-notch examples would often sell for over $800,000. A patient buyer can now find a well-documented, matching-numbers Daytona berlinetta for $550,000 to $700,000 – still a lot, but lower than it used to be. The key factors are the car’s condition and history: just having a certain badge on the car isn’t enough to command a high price anymore. What matters now is whether the car is genuine, has a rich history, and is in excellent shape.

Daytonas Available from Mecum

The five Daytonas that will be offered by Mecum are listed here: